Seafaring sector is increasing in Bangladesh.

Seafaring sector is regularly increasing in Bangladesh. Every year Bangladesh pays 900 million in freight charges for the import and export of goods on Seafaring sector Due to the small number of local ships, local shipping companies could handle only 8-10 percent of the transport trade.

New entrepreneurs are keen to invest in the seafaring sector thanks to legal protections, tax benefits and increased freight charges. They want to capture the market for the huge amount of rent that goes to foreign shipping companies in the country’s import-export trade.

Industry insiders say VAT exemptions, priority for ship berthing in the country’s seaports, the obligation to transport 50 per cent of goods in domestic shipping in the import-export trade and gradual inflation have led to growth.

Another blessing is that ship prices have dropped due to the epidemic. The price of ships dropped from 10-12 million to 5-6 million during the Great Depression. As a result, Bangladeshi Seafaring sector businesses benefit from both, they said.

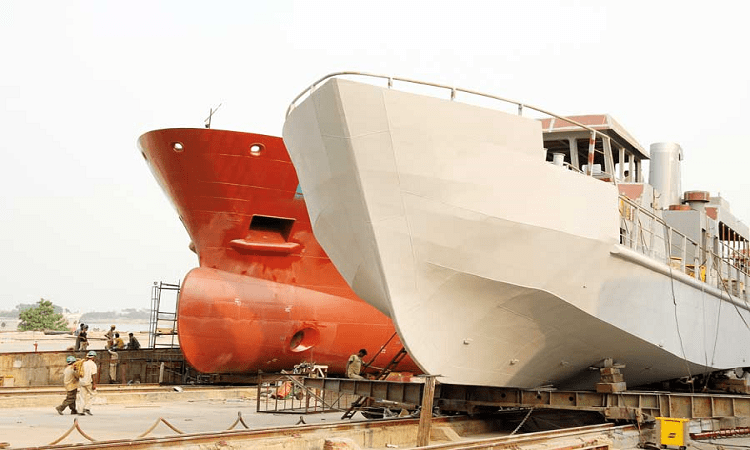

Despite the epidemic, 32 ships have been added to the fleet of sea-going ships carrying the national flag in the last two years. The total number of ships has increased from 48 in 2019 to 60 this December.

Bangladesh, meanwhile, pays কোটি 900 million a year in freight charges for freight imports and exports. Earlier, only 8-10 per cent of the freight trade could be captured by local seafaring ships. The number of ships carrying the country’s flag has increased to 20 percent; Officials at the Department of Merchant and Shipping said that there is a possibility of earning কোটি 200 million annually.

They also said that huge employment opportunities will be created here.

The impact of the epidemic on the global supply cycle has led to isolation, which has led to a sharp rise in freight rates on ships. Significant investment comes from seeing additional income opportunities. With a new investment of কোটি 500 million, the total investment here has risen to about কোটি 200 million.

For example, the Chittagong-based Kabir Group owns 23 ships. In the last three years, the company has added five new ships to its fleet. As a result, their investment since 2003 has stood at সাড়ে 345 million.

Shahriar Khan Rahat, assistant managing director of Kabir Group, told TBS: “Bangladesh will become self-reliant if it can capture the full income of foreign shipping companies from this country as freight charges. We are investing in keeping this money in the country.”

The businessman demanded a more business-friendly policy from the government in support of the sector.

Rahat said they could keep a portion of the money going abroad in the country and recommended the government to withdraw the 3 per cent tax levied on freight charges. He said they were giving cash incentives as they were earning foreign currency.

Last year, his company alone brought দেশে 100 million in freight charges to the country.

Principal Officer of the Department of Shipping Captain. Ghiyasuddin Ahmed told TBS that due to the government’s flag protection law, the highest number of ships in the history of Bangladesh has been added to the domestic fleet in the last two years. This has encouraged private entrepreneurs to invest.

He said, “At present, about 20 per cent of the import-export products in Bangladesh have the capacity to be transported on domestic-owned ships. However, there is still a lot of investment opportunity in this sector.”

Some of the major industrial groups in this sector are Meghna Group (15 ships), Akij Group has 10, Karnafuli Group has 6, Bashundhara Group has 4 and Orion Group has one. Besides, there are 6 more ships under Bangladesh Shipping Corporation, according to the Shipping Department.

The Meghna Group has launched the largest number of ships during the epidemic. During this time 32 sea-going ships started sailing from Bangladesh, out of which 10 belonged to this industrial group.

The 15 ships of Meghna Group carry 650,000 metric tons of goods per month. As such, Meghna Group ships transport 9 million metric tons of goods to different ports of the world every year.

Mohammad Abu Taher, technical manager of Mercantile Shipping, a subsidiary of the Meghna Group, said the Meghna Group currently has an investment of ৭ 375 million in 15 ships. By December 2022, 4 more ships will be added to the fleet.

Sources in the Meghna Group said that their ships carry 80 per cent of the company’s capacity. The remaining 40 percent is allocated for various domestic and foreign companies.

In 2013, there were 75 sea-going cargo ships owned by Bangladeshis. However, due to declining freight rates, this number dropped to 35 in 2016. This is due to the increase in operating costs and the withdrawal of VAT exemption on shipbuilding and imports.

Moreover, high interest rates on bank loans, image crisis, delays in registration, double taxation of various international ports and lack of protection of national flag carriers have contributed to the decline in the number of merchant ships in the country.

In this context, the government has enacted the Bangladesh Flag Carrier Ship (Protection) Act 2019. This includes VAT exemption, priority for ship berthing in the country’s seaports, 50 per cent obligation to transport goods in domestic shipping in import-export trade, up from 40 per cent earlier. Complications in ship registration have also been removed. As a result, the country’s industrialists have become interested in reinvestment in this sector.

According to Bangladesh Overseas Ship Owners Association (BOGSOA), the Seafaring sector the potential to create 600,000 jobs and generate additional কোটি 400 million in revenue.

Meherul Karim, CEO of SR Shipping Ltd, a subsidiary of Kabir Group, said the flagship (protection) law has created huge opportunities for investment in the sector. Moreover, the price of old ships has also come down a bit. As a result, entrepreneurs in this sector are investing anew. But there are more investment opportunities here.

After a decade, Karnafuli Limited has started business in this Seafaring sector by purchasing two container ships in 2020 for Tk 118 crore. The group now has six ships in its fleet.

Bashundhara Group has made new investments in the LPG ship sector. Bashundhara Group currently has 3 ships in its fleet for LPG transport. The group also owns another cargo ship.

Global shipping companies are seeing record profits as goods and ships pile up in major ports around the world. Some are making the highest profits in 117 years, while others have surpassed Apple Inc. in terms of profits.

AP Molar Myersk A / S, the world’s largest container shipping line, expects to triple its profits this year, 15 times its revenue in 2019. Another German giant, Hapag-Lloyd AG, made six months more profit than the company had made in the last 10 years.

Disruption in the global supply cycle has led to increased freight costs. Although it has become a headache for traders, producers and consumers, it is also a source of frustration for sea-going shipping companies. They are making record profits.

Due to delays in scheduled journeys, high transport fares and shipwrecks, additional surcharges continue to increase their income.

At present, the cost of a 40-foot container ship from California to China in the United States is 15 to 18 thousand dollars. Which has increased almost 10 times. The rate is expected to remain the same from the upcoming Christmas holidays until the middle of next year.

Are domestic companies investing to take advantage of this booming global shipping industry?

Business executives say this goal is part of an investment strategy. However, they have been focusing on this sector since the enactment of the Convenient Law two years ago.

In this regard, Azam J Chowdhury, President of Bangladesh Overseas Ship Owners Association, told TBS that the ships that have been invested in the national flag in the last two years are carrying their own products. So Bangladeshi entrepreneurs have more investment opportunities here.

However, for this the government has to ensure full implementation of all aspects of the flag carrier (safety) law, he said.

Anis Ud Daulah, executive director of HR Lines Limited, a subsidiary of Karnafuli Group, told TBS that the company has been involved in the shipping business for a long time. The company has added 7 more feeder ships to its fleet.

At present, these ships are capable of transporting 25,000 TEU or 20 feet equivalent units of import and export containers per month.

Kabir Group Deputy Managing Director said the high freight rates are also a major factor behind the increase in investment in the shipping sector.